- Extra payment mortgage calculator with amortization full#

- Extra payment mortgage calculator with amortization series#

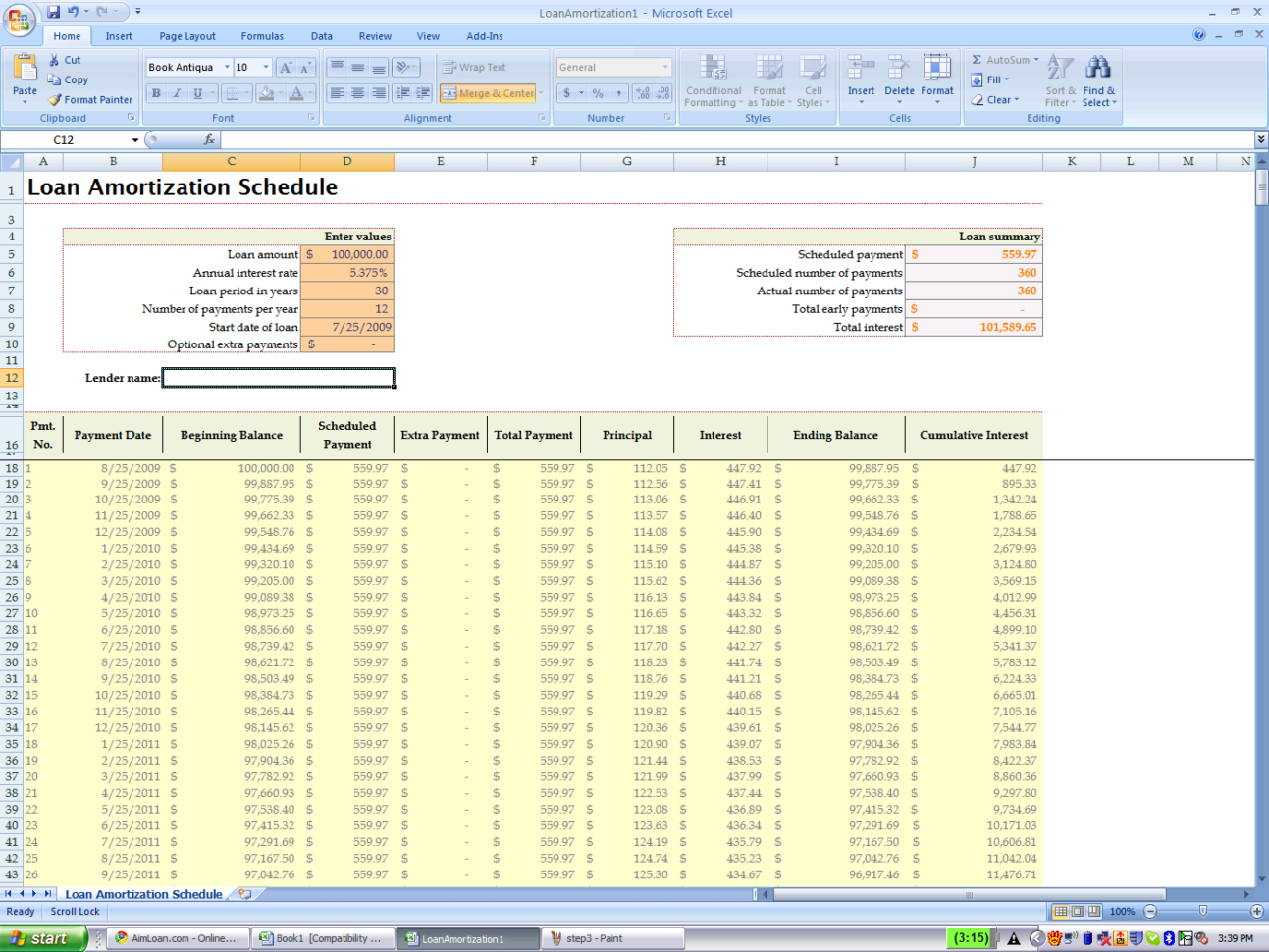

In this way, the principal balance decreases in an accelerating fashion, resulting in a shorter amortization term and a considerably lower total interest burden. The power of such an extra payment is that its amount is directly allocated to the repayment of the loan amount. In this calculator, you can set an extra payment, which raises the regular payment amount.

You may do so by a lump sum advance payment, or by increasing the periodic installments. An obvious way to shorten the amortization term is to decrease the unpaid principal balance faster than set out in the original repayment plan. It is worth knowing that the amortization term doesn't necessarily equal to the original loan term that is, you may pay off the principal faster than the time estimated with the periodic payments based on the initial amortization term. More specifically, there is a concept called the present value of annuity that conforms the most to the loan amortization framework. A few examples of loan amortization are automobile loans, home mortgage loans, student loans, and many business loans.Īs in general the core concept that governs financial instruments is the time value of money, the loan amortization is similarly strongly connected to the present value and future value of money. The amortization chart might also represent the unpaid balance at the end of each period. Typically, the details of the repayment schedule are summarized in the amortization schedule, which shows how the payment is divided between the interest (computed on the outstanding balance) and the principal. Accordingly, we may phrase the amortization definition as "a loan paid off by equal periodic installments over a specified term". The popular term in finance to describe loans with such a repayment schedule is an amortized loan.

Extra payment mortgage calculator with amortization series#

The repayment of most loans is realized by a series of even payments made on a regular basis. In case you would like to compare different loans, you may make good use of the APR calculator as well. If you are more interested in other types of repayment schedule, you may check out our loan repayment calculator, where you can choose balloon payment or an even principal repayment options as well. For these reasons, if you would like to get familiar with the mechanism of loan amortization or would like to analyze a loan offer in different scenarios, this tool will be of excellent help. If you read on, you can learn what the amortization definition is, as well as the amortization formula, with relevant details on this topic. You can also study the loan amortization schedule on a monthly and yearly bases, and follow the progression of the balances of the loan in a dynamic amortization chart. The main strength of this calculator is its high functionality, that is, you can choose between different compounding frequencies (including continuous compounding), and payment frequencies You can even set an extra payment. Monthly will show every payment for the entire term.The amortization calculator or loan amortization calculator is a handy tool that not only helps you to compute the payment of any amortized loan, but also gives you a detailed picture of the loan in question through its amortization schedule. Annually will summarize payments and balances by year. Total amount of interest you will save by prepaying your mortgage.Ĭhoose how the report will display your payment schedule. If you choose to prepay with a one-time payment for payment number zero, the prepayment is assumed to happen before the first payment of the loan. All prepayments of principal are assumed to be received by your lender in time to be included in the following month's interest calculation. For a one-time payment, this is the payment number that the single prepayment will be included in. This is the payment number that your prepayments will begin with. This amount will be applied to the mortgage principal balance, based on the prepayment type.

The options are none, monthly, yearly and one-time payment.Īmount that will be prepaid on your mortgage. This total interest amount assumes that there are no prepayments of principal.

Extra payment mortgage calculator with amortization full#

Total of all interest paid over the full term of the mortgage.

This total payment amount assumes that there are no prepayments of principal. Total of all monthly payments over the full term of the mortgage. Monthly principal and interest payment (PI). The most common mortgage terms are 15 years and 30 years.Īnnual fixed interest rate for this mortgage. The number of years over which you will repay this loan. Original or expected balance for your mortgage.

0 kommentar(er)

0 kommentar(er)